August Market Check-In: What’s Happening in McFerrin Park, Cleveland Park, and Highland Heights

If you’ve been feeling a shift in the market lately, you’re not wrong—and the July numbers from Realtracs confirm it. Here in McFerrin Park, Cleveland Park, and Highland Heights (MPCPHH), we saw some surprising movement this month—especially on pricing.

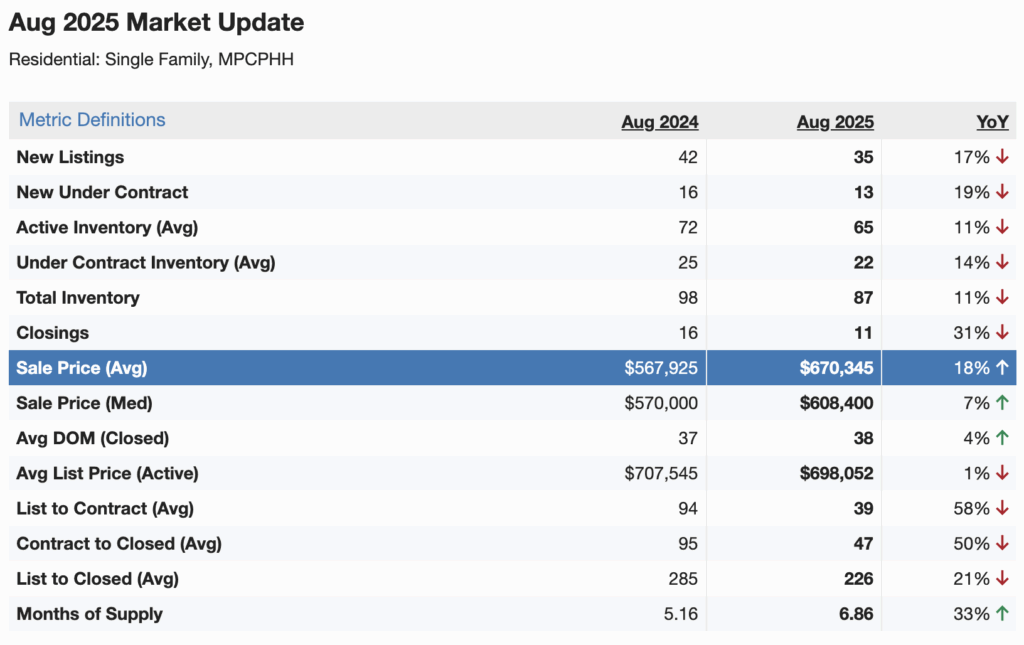

Let’s start with the headline: the average sale price jumped to $670,345, up 18% from this time last year. That’s a big leap—and it’s not just a fluke. The median price also rose 7% to $608,400, which tells us that this increase is widespread, not just skewed by a few luxury sales.

So how is that possible in a slower market? Well, we’re seeing fewer listings overall—down 19% year-over-year—and fewer closings too (only 11 this August vs. 16 last year). Fewer homes are trading hands, but the ones that are, seem to be commanding a premium. And in these neighborhoods where location, architectural charm, and proximity to downtown still matter, buyers are clearly willing to pay for what they want.

That said, it’s taking longer to get from list to close. The average list-to-contract time ballooned 58% to 39 days, and contract-to-close jumped 50% to 47 days. So if you’re selling, know that you might need to budget for a longer marketing period and escrow process.

Inventory levels are slightly down compared to last year, but what’s more important is months of supply, which climbed to 6.95 months—a 35% increase. That puts us firmly into a buyer-leaning market, at least statistically. But in practice? Good listings still move.

And that’s what this market is really about right now—quality over quantity. Buyers are being choosier. Homes that are priced well and dialed-in with staging, maintenance, and solid marketing are still seeing competitive attention. But if you’re a seller sitting on tired finishes or overly optimistic pricing, you’re likely to linger on the market.

From a boots-on-the-ground perspective, I’m seeing more strategic buyers circling—especially those looking for homes with flexible layouts (think: income-producing ADUs or separate offices), and homes walkable to shops like Redheaded Stranger, Xiao Bao, or Forevermore Coffee.

So what’s next? Expect September to feel similar. Pricing strength is holding in our micro-neighborhoods, but time-on-market is stretching. If you’re a seller considering fall or winter, planning is key. If you’re a buyer, you might find a little more leverage—but don’t sleep on the best listings. They still go quickly.

Got questions about a specific property or want to run numbers on your own home? Let’s chat. I live here, work here, and know the difference between a “for sale” house and a “heck yes” house.

Reach out if you are curious about your home’s current value!

Nick Irwin | BaseNashville

nick@basenashville.com

615.418.0563

_____

ONWARD | 615.656.8599