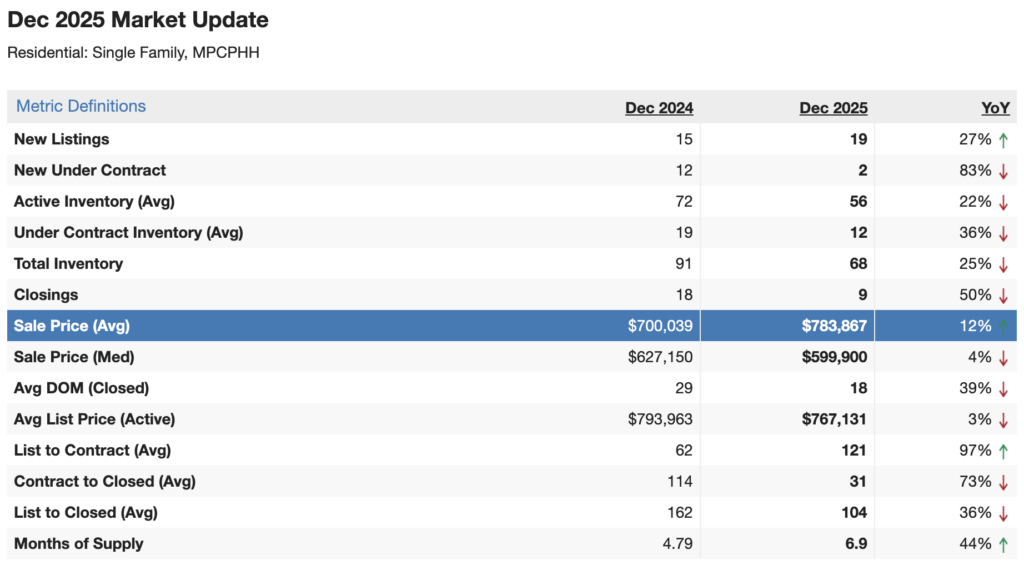

December 2025 Market Analysis: McFerrin Park, Cleveland Park & Highland Heights Real Estate Trends

As we close the books on 2025 and look ahead to what promises to be an interesting year in real estate, I wanted to share a comprehensive analysis of how our local market performed in December. After over five years of tracking real estate trends in McFerrin Park, Cleveland Park, and Highland Heights, I’ve learned that understanding the data is key to making informed decisions—whether you’re buying, selling, or simply keeping an eye on your home’s value.

December 2025 by the Numbers

December brought some notable shifts that paint a picture of a market in transition. Here’s what the data tells us:

Price Trends:

- Average sale price reached $783,867, representing a 12% increase year-over-year

- Median sale price came in at $599,900, up 4% from December 2024

- Active listing prices averaged $767,131, down just 3% from last year

Inventory and Activity:

- New listings increased 27% to 19 homes

- Active inventory dropped 22% to 56 homes

- Total inventory decreased 25% to 68 homes

- Only 9 closings occurred, down 50% from 18 closings in December 2024

Market Timing:

- Average days on market for closed properties: 18 days (down 39% from 29 days)

- Time from listing to contract: 121 days (up 97%)

- Time from contract to closing: 31 days (down 73% from 114 days)

- Overall list-to-close timeline: 104 days (down 36%)

- Months of supply: 6.9 (up 44% from 4.79)

What These Numbers Really Mean for Our Neighborhoods

Living and working in McFerrin Park, Cleveland Park, and Highland Heights gives me a unique perspective on how these statistics translate to real-world conditions in our community. The 12% price increase might seem counterintuitive given the 50% drop in closings, but it actually tells a coherent story about our current market dynamics.

The Quality-Over-Quantity Market

December’s dramatic decrease in transaction volume—from 18 closings to just 9—signals that buyers have become significantly more selective. This isn’t necessarily negative; it reflects a market where purchasers are taking their time, being thorough with inspections, and only pulling the trigger when they find the right property at the right price.

The fact that average sale prices rose 12% despite lower volume indicates that the homes which did sell were higher-quality properties or properties in particularly desirable locations within our neighborhoods. In conversations with buyers throughout the year, I’ve noticed a distinct shift toward prioritizing location, condition, and long-term value over simply getting into the market at any cost.

Speed When It Counts

One of December’s most revealing metrics is the 18-day average time on market for closed properties—a 39% improvement from last year’s 29 days. This tells us that well-priced, well-presented homes in McFerrin Park, Cleveland Park, and Highland Heights are still attracting serious buyers quickly.

Even more impressive is the 73% reduction in contract-to-close time, dropping from 114 days to just 31 days. This dramatic improvement suggests several positive developments:

- Smoother transactions: Buyers are coming to the table better prepared with financing and fewer contingencies

- Realistic pricing: Sellers and their agents are setting accurate expectations, reducing the likelihood of appraisal issues

- Professional cooperation: The local real estate community has refined processes for efficient closings

The challenge lies in the 97% increase in list-to-contract time (now averaging 121 days). This indicates that while closings happen quickly once buyers commit, getting buyers to that commitment point takes considerably longer. For sellers, this underscores the importance of patience and maintaining your property’s showing condition over an extended marketing period.

Inventory Dynamics in Our Neighborhoods

The 25% drop in total inventory to 68 homes, combined with a 27% increase in new listings, creates an interesting dynamic. We’re seeing homes move through the system—but at a slower pace than in previous years. The 6.9 months of supply indicates we’re firmly in buyer-friendly territory (a balanced market is typically considered 6 months of supply).

For context, in McFerrin Park, Cleveland Park, and Highland Heights specifically, this inventory level means buyers have genuine choices without the overwhelming options that can lead to decision paralysis. It’s a manageable selection that allows serious buyers to view most available properties in their price range within a reasonable timeframe.

The Price-Expectation Gap

The 3% decrease in average list prices ($767,131) compared to the 12% increase in average sale prices ($783,867) reveals that properties closing in December were either exceeding their list prices or the homes that closed were initially listed higher than the current active inventory. This suggests that properly priced homes in desirable pockets of our neighborhoods are still commanding strong prices, while overpriced listings are sitting on the market.

Neighborhood-Specific Insights

McFerrin Park

McFerrin Park continues to attract buyers looking for proximity to downtown amenities while maintaining a distinct neighborhood character. The area’s walkability and community feel remain strong selling points. In December, I observed that homes with updated kitchens and outdoor living spaces continued to perform particularly well, often generating multiple offers when priced competitively.

The neighborhood’s tight-knit community and active neighborhood association add intangible value that doesn’t always show up in comparable sales data but definitely influences buyer decisions. Properties here that closed in December tended to be move-in ready, suggesting buyers are willing to pay a premium to avoid renovation projects.

Cleveland Park

Cleveland Park’s appeal remains strong, particularly among families drawn to the area’s parks, schools, and established tree-lined streets. December activity here reflected the broader market trends, with well-maintained homes in the neighborhood’s most sought-after blocks moving efficiently.

One notable trend I’ve observed: buyers in Cleveland Park are increasingly focused on lot size and outdoor space. Properties with larger yards or private outdoor areas consistently commanded the higher end of the price spectrum, even when interior square footage was comparable to smaller-lot alternatives.

Highland Heights

Highland Heights continues to benefit from its central location and diverse housing stock. The neighborhood’s mix of housing styles—from classic bungalows to larger family homes—means it attracts a wide range of buyer demographics.

In December, I noticed that Highland Heights properties with original character details (hardwood floors, built-ins, architectural details) that had been thoughtfully updated rather than stripped away performed particularly well. There’s a growing appreciation for homes that balance historic charm with modern functionality.

Strategic Considerations for 2026

As we move into the new year, here’s what buyers and sellers in McFerrin Park, Cleveland Park, and Highland Heights should keep in mind:

For Sellers

Price with precision from day one. The market has shown it will reward accurately priced homes with relatively quick sales (18 days to contract), but overpricing will cost you months of market time. With 121 days average from listing to contract, every day your home sits overpriced is a day of opportunity cost.

Invest in presentation. With buyers being more selective and taking longer to commit, your home needs to make a strong first impression and maintain it throughout the marketing period. Professional photography, staging consultation, and keeping the property show-ready for an extended period are all crucial.

Be patient but flexible. The extended list-to-contract timeline means you need patience, but once you receive a qualified offer, be prepared to negotiate constructively. The market is rewarding sellers who work with serious buyers rather than holding out for unrealistic terms.

Consider timing strategically. While new listings were up 27% in December, this is historically a slower time for real estate. If your situation allows flexibility, working with a knowledgeable local agent to identify the optimal listing window for your specific property could make a significant difference.

For Buyers

Take your time, but stay ready to move. The 6.9 months of supply means you have options and negotiating leverage, but the 18-day average market time for closed properties shows that the right homes still attract quick action. Be thorough in your search, but have your financing lined up and be prepared to act decisively when you find the right property.

Look beyond list price. With the gap between list prices and sale prices, focus on the value proposition of each property rather than fixating on the asking price alone. A well-priced home at $750,000 may represent better value than a comparable property listed at $700,000 that’s overpriced.

Prioritize location and condition. The market data suggests buyers are focusing on quality over quantity. Properties in the most desirable locations and in the best condition are still commanding premium prices and moving relatively quickly. If you find a property that checks both boxes, recognize its value.

Work with neighborhood expertise. General market trends are helpful, but McFerrin Park, Cleveland Park, and Highland Heights each have distinct characteristics that influence value. An agent with deep neighborhood knowledge can help you identify opportunities and avoid overpaying.

Looking Ahead

The December numbers suggest our market is finding a new equilibrium after the volatility of recent years. We’re seeing quality rewarded, patience required, and strategic thinking valued over reactionary decisions.

The 12% price increase indicates sustained demand in our neighborhoods, while the increased months of supply and extended marketing times show that buyers have regained negotiating position. This balanced dynamic—assuming it continues—could actually make 2026 one of the more stable and predictable years we’ve seen in real estate recently.

For those of us who call McFerrin Park, Cleveland Park, or Highland Heights home, these market conditions reflect our neighborhoods’ enduring appeal. These areas continue to attract buyers who value community, location, and quality of life—factors that remain constant regardless of broader market fluctuations.

Your Neighborhood Real Estate Resource

As someone who lives in this community and has been tracking these neighborhoods for over five years, I’m always happy to discuss how these broader trends might impact your specific situation. Whether you’re considering selling, starting your home search, or simply want to understand your home’s current value, I’m here as your neighborhood resource.

The real estate market is always evolving, and local expertise matters more than ever. If you have questions about how December’s numbers translate to your street, your home, or your plans for 2026, let’s talk. You can reach me at [contact information], and I’m always happy to grab coffee and discuss our neighborhood market.

Here’s to a successful 2026 in McFerrin Park, Cleveland Park, and Highland Heights!

Market data sourced from MPCPHH MLS for single-family residential properties, December 2025. All analysis and insights represent professional opinion based on local market expertise and should not be considered financial or investment advice.